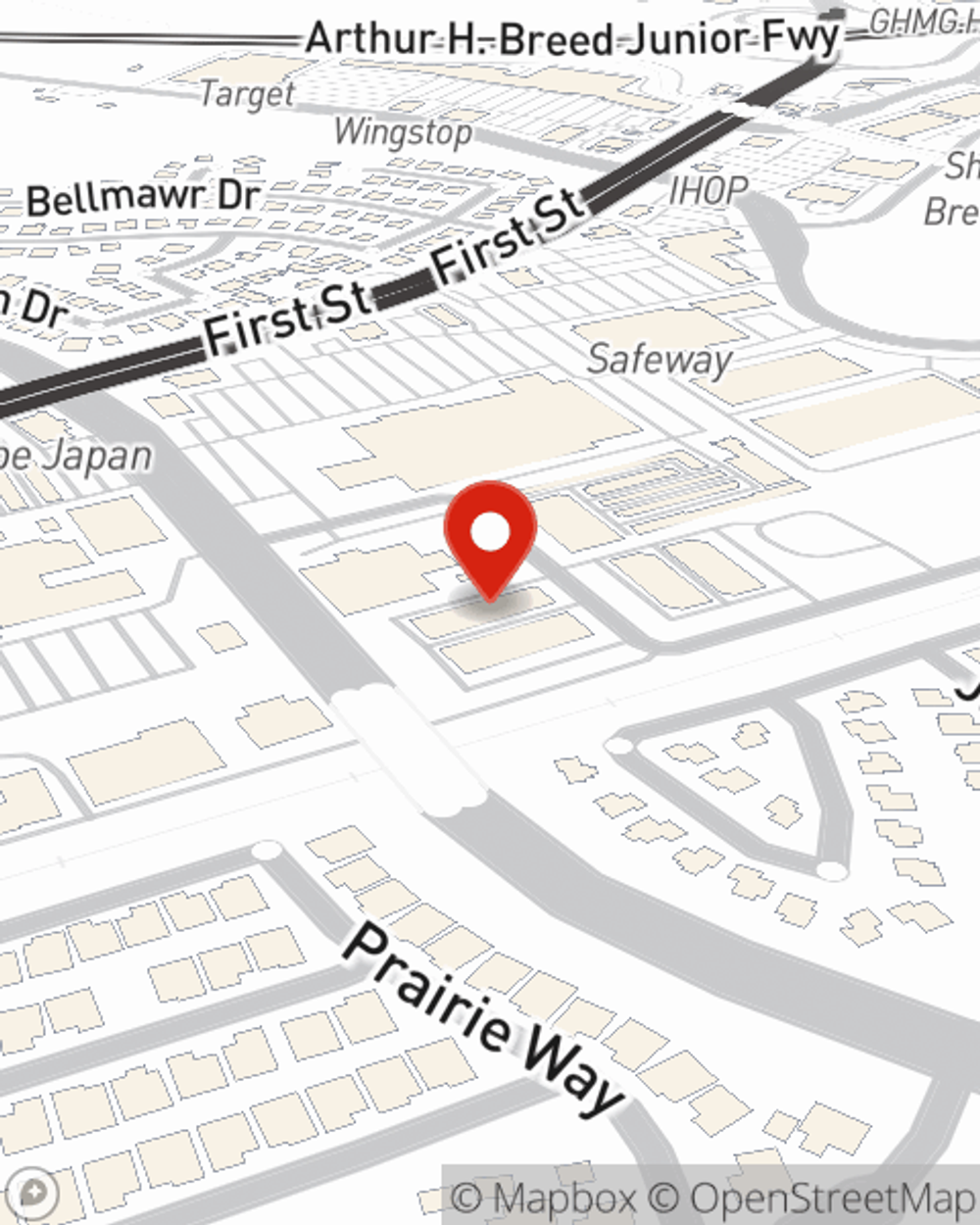

Life Insurance in and around Livermore

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Would you like to create a personalized life quote?

- Livermore

- Pleasanton

- Dublin

- Sunol

- San Ramon

- Danville

- Discovery Bay

- Brentwood

- Tracy

- Manteca

- Lathrop

- Sacramento

- Folsom

- Citrus Heights

- Roseville

- El Dorado Hills

- North Lake Tahoe

- California

- Arizona

- Nevada

Be There For Your Loved Ones

Taking care of those you love is a big deal. You listen to their concerns go to work to provide for them, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Life happens. Don't wait.

Life Insurance Options To Fit Your Needs

And State Farm Agent Keith Hall is ready to help design a policy to meet you specific needs, whether you want coverage for a specific time frame or coverage for a specific number of years. Whichever one you choose, life insurance from State Farm will be there to help your loved ones keeping going, even when you can't be there.

Simply visit State Farm agent Keith Hall's office today to check out how the State Farm brand can work for you.

Have More Questions About Life Insurance?

Call Keith at (925) 447-3400 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.

Simple Insights®

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

What determines the cost of life insurance?

What determines the cost of life insurance?

How do life insurance companies determine rates? And who pays more for life insurance? We break it down.